Investment Portfolio Managment

Calderwood Financial follows a well-defined, time proven process to help increase the probability you will meet your financial objectives. Our process is designed to replicate the intricate and highly disciplined approach that institutional money managers use.

Your portfolio strategy begins with a personalized investment analysis, then graduates through the portfolio construction process to meet your investment objectives.

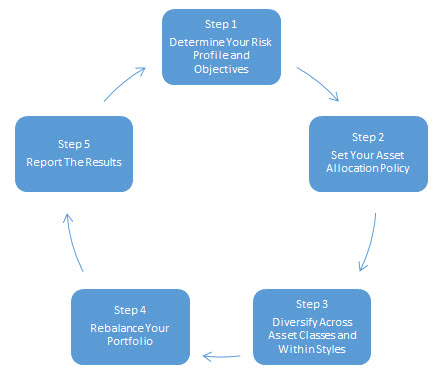

The result is a well-tuned, five step asset management process designed to respond to your individual needs while responding to the dynamics of capital markets.

Step 1

Through personal consultations with you, we develop a personal profile of your individual investment needs and objectives, time horizon, and attitude toward investing.

Step 2

We develop a personalized asset allocation policy, based on your needs and objectives, to potentially increase your investment returns relative to your risk tolerance through the careful diversified allocation of your investments.

Step 3

Your asset allocation policy is implemented by investing in a well-diversified portfolio managed by institutional money management firms, not normally accessible to an individual investor.

Step 4

Your investment portfolio is carefully monitored to ensure it remains consistent with your asset allocation policy. If the relative value of investments in your portfolio changes enough to become inconsistent with this policy, it is rebalanced.

Step 5

We will communicate with you on a regular basis and provide a comprehensive reporting package, including level performance reports.